REE operates under a Holdings model with key areas of business including Mechanical and Electrical Engineering, Real Estate, Energy, and Water. In 2021, the energy segment surpassed mechanical and electrical engineering to become REE’s largest revenue contributor, accounting for 51% of the company’s total revenue.

Ms. Nguyen Thi Mai Thanh, Chairwoman of the Board of Directors, stated that the Energy sector recorded an outstanding year largely due to favorable hydrological conditions and the full-year operation of the 86 MWp rooftop solar power projects that commenced commercial operations at the end of 2020, along with the stable performance of the Water sector.

The Office Leasing sector continued to maintain a high occupancy rate despite the significant changes in office rental practices due to the fourth wave of the COVID-19 pandemic.

These positive results offset the slowdown in the Mechanical and Electrical Engineering sector, where most construction projects nationwide were temporarily halted due to the pandemic and intense competition in the air conditioning market.

Meanwhile, new projects in the Real Estate Development sector are still in the initial stages of implementation, so they have not yet recorded revenue and profit.

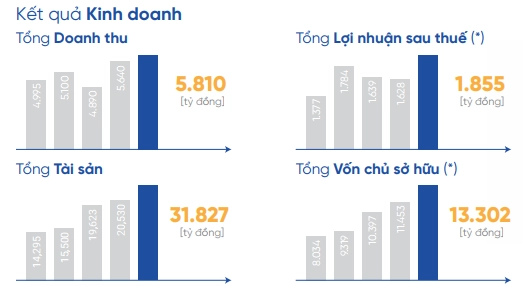

REE’s balance sheet demonstrates financial strength with total equity of 13.302 trillion VND, up 16.1% from the previous year. Consolidated net debt at the end of 2021 was 9.230 trillion VND, equivalent to a net leverage of 56.4% – a 26.8% increase from 29.6% in 2020, due to new loan disbursements for the Tra Vinh V1-3 wind power project at the Parent Company and for the Loi Hai 2 and Phu Lac 2 wind power projects at Thuận Bình Wind Power JSC, along with the consolidation of Vĩnh Sơn – Sông Hinh Hydro Power JSC from Q2 of this year.

Key Activities of the Year

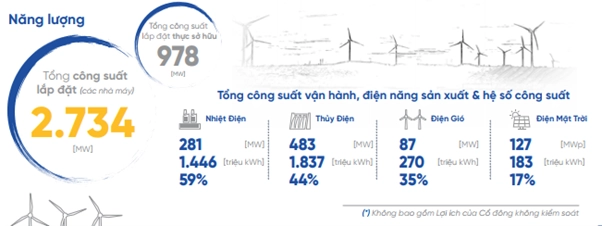

In the energy sector, REE has been involved since 2010 and currently owns a diverse portfolio ranging from hydropower, wind power, solar power, to long-established coal-fired power plants. The total installed capacity is 2.734 MW, with an actual owned capacity of 978 MW. The group’s power plants currently contribute nearly 12 billion kWh to the national electricity output.

REE has significantly reduced its investments in coal-fired power, aligning with the global joint declaration on transitioning from coal to clean energy – one of the six initiatives Vietnam committed to at COP26. Last year, REE reduced its holdings in Quang Ninh Coal Thermal Power (QTP) from 8.04% to just 0.98% and plans to divest the remaining shares soon.

Specifically, in hydropower, in 2021, REE Energy LLC increased its stake in Vĩnh Sơn – Sông Hinh Hydro Power JSC (VSH) to 50.5%. According to Ms. Mai Thanh, this controlling stake allows REE to actively participate in the strategic decisions of VSH. The Thượng Kon Tum hydropower plant commenced operations in April 2021 after more than 12 years of construction, contributing over 976 million kWh of electricity by the end of 2021.

In wind power, three projects with a total capacity of 102 MW – including the Tra Vinh V1-3 (48 MW – Tra Vinh), Loi Hai 2 (28.9 MW – Ninh Thuan), and Phu Lac 2 (26 MW – Binh Thuan) plants – commenced commercial operations at the end of October 2021. The fixed preferential electricity prices for these plants are 9.8 US Cents/kWh (for the Tra Vinh V1-3 project) and 8.5 US Cents/kWh (for the other two projects).

For rooftop solar power projects, 93 MWp has been deployed and contributes to the use of clean energy by many businesses.

The Mechanical and Electrical Engineering sector of REE regained growth momentum in the last months of the year with new contracts totaling 3.757 trillion VND, a 60.7% increase compared to the same period, laying the foundation for revenue and profit in 2022.

In the Water sector, REE Water LLC acquired a 65% stake in TK Joint Stock Company to expand REE Water’s activities in the water industry.

In Real Estate Development, REE Land LLC, in collaboration with SaigonRes, is developing the Phu Hoi Residential Area in Nhon Trach District, Dong Nai Province, covering 7.9 hectares. Additionally, REE Land successfully divested from VIID, recording a profit of 163 billion VND from the share transfer.

Ms. Mai Thanh stated, “For each operating sector, our strategic goal remains to significantly increase the group’s asset portfolio, boost investment to scale up the Energy and Water sectors, expand commercial office space, and build land funds for project development.”

This year, the digital transformation process will be intensified as REE explores investment in potential innovative technology projects. REE has partnered with Zone Startups Vietnam to discover high-potential innovative technology projects and will proceed to invest in projects that align with the group’s existing ecosystem.

Source: Doanh Nghiệp Tiếp Thị