(ĐTCK) Over the past two decades in the Vietnamese stock market, amidst the bustling arrival and departure of various players, the Refrigeration Electrical Engineering Corporation (REE), one of the first two companies to list its shares on the exchange, has continued to grow robustly.

In the recent volatile market period, REE has made a remarkable turnaround, reaching new price peaks.

Steady Growth

On the trading session of June 17, 2022, REE’s stock price reached a historic high of 99,000 VND per share, more than six times higher than its initial trading session (16,000 VND per share) and more than double that of a year ago. Notably, this peak was achieved during a strong market downturn. Compared to the beginning of the year, REE’s stock price increased by about 65%, while the VN-Index fell nearly 20% over the same period.

During the market’s strong correction phase after the long bullish wave in 2021 – 2022, especially amid concerns about inflation and global economic recession, tightening monetary policies, investors turned to REE as a safe haven for their capital.

Indeed, REE is one of the regularly included stocks in the VN30 basket, highly regarded by domestic and international investment institutions, and frequently recommended for investment due to its potential for sustainable growth. Despite the significant impact of the Covid-19 pandemic on the business community in 2021 – 2022, REE’s earnings per share (EPS) remained around 5,000 VND, placing it among the best-performing companies on the stock exchange.

Refrigeration and electrical engineering has been REE’s main business area since its establishment in 1977, and REE is a leader in the mechanical and electrical contracting (M&E) sector. However, this area is highly competitive and has low-profit margins, about 5%, so REE focuses on investing in sectors with better business prospects like real estate, energy, and clean water.

This strategy has enabled REE to maintain high business efficiency throughout its more than two decades in the stock market.

Entrepreneur Nguyen Thi Mai Thanh, Chairwoman of the REE Board of Directors, who played a pivotal role in REE’s rise from a small state-owned enterprise, was instrumental in creating a turning point for REE, believing that “REE would always be small if it only focused on refrigeration and electrical engineering, despite this being its core business.”

Venturing into real estate, particularly the office leasing segment, was the first step in diversifying its business sectors, proving the correctness of the strategy set by the company’s leadership.

Successively, office buildings like e.town 1, followed by e.town 2, 3, 4, 5, were put into operation, generating substantial and stable cash flows for the company. It is anticipated that in September 2023, the e.town 6 office building will be operational, contributing over 200 billion VND in annual revenue for the company.

In the clean water business, the company is currently a major shareholder in several enterprises in the industry, such as BOO Thủ Đức Water JSC, Saigon Water Investment and Trading JSC, Tân Hiệp Water Investment JSC, Sông Đà Water Investment JSC, Thủ Đức Water Supply JSC, Khánh Hòa Water Supply and Drainage JSC… REE’s current water production capacity is nearly 1.3 million m3/day.

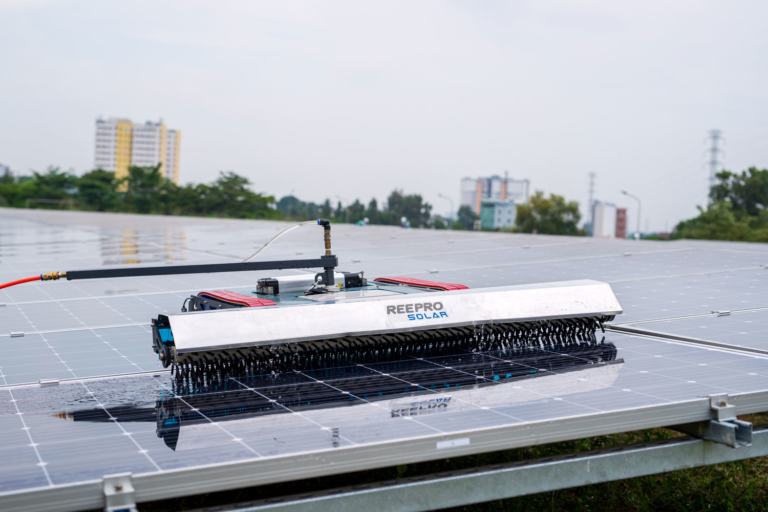

Entering the energy sector in 2010, REE now owns a portfolio spanning from hydropower, wind power, solar power to long-established coal-fired power plants. This diversifies the company’s risks and capitalizes on opportunities arising from weather and hydrological conditions. The total installed capacity is 2,734 MW, with an actual owned capacity of 978 MW. The group’s power plants currently contribute nearly 12 billion kWh to the national electricity output.

Continuously Exploring Potential Business Areas

According to the 2021 annual report, REE set a revenue target of 9,247 billion VND and a net profit of 2,061 billion VND for this year, growing by 59% and 11% respectively compared to last year. Energy is the main contributing sector, with a revenue of 4,138 billion VND, up 40% from 2020.

Securities firm SSI believes that hydropower will lead REE’s growth in 2022, benefiting from favorable hydrological conditions. REE-owned hydropower companies, including Vĩnh Sơn – Sông Hinh, Thác Bà, Thác Mơ, Sông Ba Hạ, Central Hydropower, have all reported positive results compared to their peers.

REE’s current main business segments are electrical engineering, renewable energy, real estate, and clean water – environment.

Earlier, at the 2022 Annual General Meeting, Chairwoman Nguyen Thi Mai Thanh affirmed: “In the context of domestic coal depletion and rising coal and oil prices, hydropower will be the most competitively priced source.”

MB Securities (MBS) recently reported that the input material costs for hydropower plants are only about 3% of production and business costs, thus having the lowest production cost in the electricity sector. The gross profit margin of REE’s hydropower companies mainly ranges from 50 – 65%, significantly higher than the gross margins of thermal and gas power companies (10 – 15%). Accordingly, MBS forecasts REE’s EPS for this year at 6,678 billion VND.

Meanwhile, BSC projects REE’s revenue for this year to reach 9,484 billion VND and a net profit of 3,446 billion VND, growing by 63% and 61% respectively compared to last year. The M&E segment is expected to have potential in the medium and long term; the real estate and office leasing sector continues to be stable with an occupancy rate of over 90%. Additionally, the clean water business and especially power production are expected to grow, led by hydropower and renewable energy.

In the long term, analysts see REE’s potential in the clean energy sector, including wind and solar power. For solar power, there is abundant renewable energy potential in the South, as the electricity supply is not yet sufficient, and there are few large-capacity hydropower plants in this region. Additionally, the Southern climate is particularly suitable for deploying solar panel projects.

With wind power, REE currently holds shares in 4 wind power plants with a total capacity of 126 MW, including 3 that have been in commercial operation since October 2021 and all benefit from the FIT pricing policy.

MBS estimates that the ROE for REE’s wind power projects is about 17%, an attractive return rate. Wind power is a clean energy source with advantages like stable and predictable costs due to low operating expenses and no fuel costs, and shorter construction times.

According to the draft of the Eighth Power Development Plan, the wind power capacity is 13,616 MW by 2025, leaving about 7,180 MW to be developed. With solid financial resources and a high credit rating, REE is seen as a potential candidate to invest in this clean energy sector.

Continuously seeking potential business opportunities and enhancing the effectiveness of shareholder and investor capital, REE has made a remarkable impression in the market as a pioneering enterprise.

Source: Tin nhanh chứng khoán