REE continues its M&A activities across all sectors, as opportunities abound in areas like electricity, water, and real estate for quick and effective investments.

The 2022 AGM of Refrigeration Electrical Engineering Corporation (REE) on March 31 approved a revenue plan of 9.247 trillion VND, a 59% increase, and a post-tax profit of 2.061 trillion VND, an 11% growth compared to 2020. This target is based on expectations of revitalized construction, real estate, and public investment projects as the pandemic situation is brought under control.

Despite the significant increase in revenue for 2022, the modest profit growth raised shareholder questions at the meeting. Ms. Nguyen Thi Mai Thanh explained that the mechanical and electrical engineering segment contributes significantly to revenue but has a low profit margin of about 5-6% due to intense competition and rising material costs.

In revenue structure, the mechanical and electrical engineering segment is expected to achieve 3.930 trillion VND in revenue, a 116% increase, and a post-tax profit of 214 billion VND, up 119% from a low base in 2021 due to the pandemic. REE estimates it could achieve a contract value of 5 trillion VND, a 33% increase from last year.

According to REE, the 2022 market for construction, real estate, and public investment is expected to be the main driver for the mechanical and electrical engineering segment. However, the rising and unpredictable prices of materials and geopolitical tensions could impact the company’s profit margins.

Mr. Nguyen Thanh Hai, CEO of REE, affirmed that the mechanical and electrical engineering sector remains a core traditional activity. The company will focus on complex infrastructure projects such as Long Thanh Airport, five-star hotels, and expand services in warranty, maintenance, and renewable energy contracting.

The energy segment is also a key focus for 2022, expected to contribute 4.138 trillion VND to the company’s revenue (a 40% increase from 2021) and a post-tax profit of 1.024 trillion VND, accounting for 50% of the group’s total profit, a 17.3% increase.

The driving force includes three wind power projects with a total capacity of 102 MW, including the Tra Vinh V1-3, Loi Hai 2, and Phu Lac 2 plants, commercially operational since late October 2021.

In particular, the fixed preferential electricity price is 9.8 US Cents/kWh for Tra Vinh V1-3 and 8.5 US Cents/kWh for the remaining two plants. At the same time, the Thuong Kon Tum hydropower plant project officially came into operation in April 2021 after more than 12 years of construction.

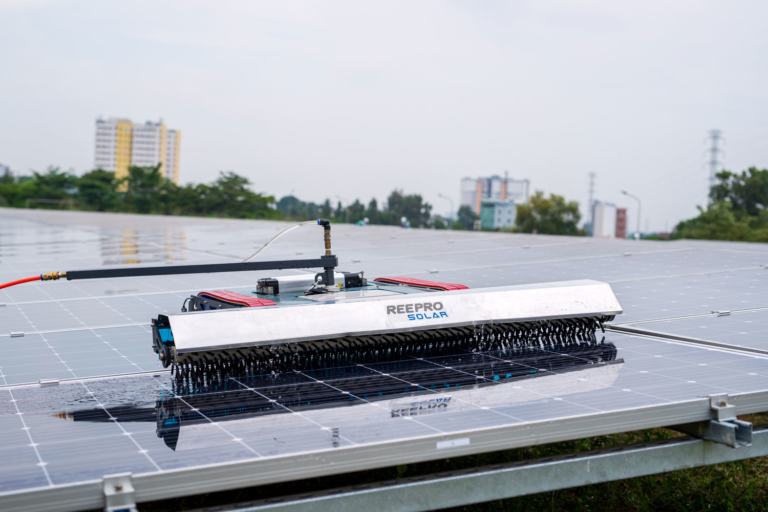

Ms. Mai Thanh shared insights on rooftop solar energy, indicating that the Eighth Power Development Plan would positively impact solar energy, and REE will continue to seek contract opportunities for installation and electricity sales to customers.

REE’s investment model involves converting its own capital into bank loans after project completion and operation.

The office leasing sector is expected to generate 1.026 trillion VND in revenue, a 10% increase, and a post-tax profit of 500 billion VND, up 8.6%. REE leaders anticipate a recovery in the office leasing market with a slight increase in rental prices this year.

In Q3 2021, the company reduced rent by 20% to support tenants affected by Covid-19. However, prices have returned to normal levels this year, according to Mr. Hai.

The Etown office project is expected to launch in 2023, targeting a younger clientele with higher standards than REE’s current buildings.

In contrast, the real estate development segment might see a 70% decrease to 50 billion VND in profit. REE plans to develop more land for new potential commercial housing projects.

Ms. Mai Thanh mentioned pursuing 3-4 projects, noting the long-term, high-risk nature of land development. With the government’s policy of public land auctions, even extensive research and planning might not guarantee a successful bid.

Therefore, REE is exploring M&A opportunities for existing projects or partnering with landowners lacking resources for development.

The water sector is projected to contribute 154 billion VND in revenue, a 67% increase, and a post-tax profit of 307 billion VND, up 12% from 2021. REE Water continues to seek M&A opportunities in water production and supply plants while upgrading existing plant capacities.

Mr. Hai emphasized REE’s ongoing strategy to expand in the water sector.

In 2021, the post-tax profit attributable to the parent company’s shareholders was 1.855 trillion VND. Accordingly, the company will pay a 2021 dividend of 25%, including 10% in cash and 15% in shares.

The Board also sought shareholder approval for rewarding management staff with outstanding performance in 2022 with treasury shares. REE plans to sell over 1 million treasury shares it currently holds to employees at 10,000 VND/share, expected to be executed in the first six months of 2023.

Discussion at the AGM included Ms. Mai Thanh, Chairwoman of the Board, and Mr. Huynh Thanh Hai, CEO, addressing shareholder queries.

On the potential and contribution of the energy segment in the future:

Ms. Mai Thanh: Renewable energy is REE’s strategic investment sector. Currently, the company’s portfolio includes only one thermal power company, with the rest being clean energy like wind, solar, and hydropower. REE will continue to seek investment opportunities in renewable energy.

The new employee, a member of the Board of Directors, has much experience in this field and is expected to contribute to the upcoming development of the business.

Regarding the potential of renewable energy, Vietnam’s geographical position is favorable for its development. Solar energy in the South develops better than in the North, while wind energy, especially offshore, holds immense potential.

Not to mention, Vietnam’s electricity planning is following the development trend for renewable energy to replace coal thermal power – which is increasingly depleting the supply of raw materials and causing environmental pollution.

On REE’s stance on environmental protection and plans to divest from polluting coal-fired power:

Mr. Huynh Thanh Hai: REE is particularly focused on renewable energy, and its investment offices are aligned with this, installing rooftop solar systems. Due to this investment direction, the group has planned to divest from thermal power.

Last year, REE divested from Quang Ninh Coal, and Pha Lai Thermal Power will also be divested in the future, as part of an existing roadmap.

Further details on the backlog contract in the mechanical and electrical engineering segment:

Mr. Huynh Thanh Hai: By the end of last year, REE had signed contracts worth about 3.7 trillion VND, and this year the company aims for 5 trillion VND.

Board management’s assessment of electricity price increase:

Ms. Mai Thanh: In the context of coal, oil, and gas shortages, electricity prices will inevitably increase. Hydropower will become more prominent due to its low cost.

The Kon Tum Upstream Plant’s electricity price in the first three months of the year reached 1,400 VND/kWh, while the cost was only 900 VND/kWh. EVN has not yet fixed the price for the plant due to additional project settlement requirements, and the long project completion time was due to the Chinese contractor withdrawing.

It will be completed by April 2021, when REE participates in implementation. However, this doesn’t affect the factory’s efficiency.

On the high remuneration of the Board:

Ms. Mai Thanh: In my opinion, this year’s remuneration is low compared to the role in supporting and guiding the company’s management in the right direction.

On the company’s M&A plan:

Ms. Mai Thanh: REE continues to equally distribute its focus across all current sectors, as there are many investment opportunities in electricity, water, and real estate that can be quickly capitalized on for effective returns.

On the five-year development strategy of the group:

Ms. Mai Thanh: The Board has a strategy and will discuss it before communicating with the management and shareholders.

I can reveal that by 2025, the Board aims to double REE’s current market capitalization and achieve billions in USD revenue, a significant increase from the current 10 trillion VND.

On investment plans and capital arrangements for this year:

The company plans to invest 1.2 trillion VND in rooftop solar projects, aiming for a 1GB capacity. The funding will be arranged with a 30% equity and 70% debt ratio.

For the Etown 6 project, REE already has a bank agreeing to finance 65% of the capital.

On the company’s plan for handling used solar panels:

Mr. Huynh Thanh Hai: It’s too early to focus on this issue. When many solar panels near their end of life, several processing plants for expired panels will emerge in the region.

Source: Báo Đầu Tư